Today, the Pandemic Response Accountability Committee (PRAC) issued a Fraud Alert follow-up that shows the potential benefits of agencies using the Department of Treasury’s (Treasury) Do Not Pay (DNP) system to prevent and detect fraud.

“Improved data sharing will enable agencies to properly screen applicants for benefit programs to ensure funding goes to the individuals they were intended to help,” said PRAC Chair Michael E. Horowitz. “In many cases, agencies initially relied on self-certification to verify an applicant’s eligibility for pandemic relief. Now, we’re chasing billions of dollars that got into the wrong hands.”

This update expands on our previous Fraud Alert, which identified 69,000 questionable SSNs used to obtain $5.4 billion in potentially fraudulent loans and grants from the Small Business Administration’s (SBA) COVID-19 Economic Injury Disaster Loan (EIDL) program and Paycheck Protection Program (PPP).

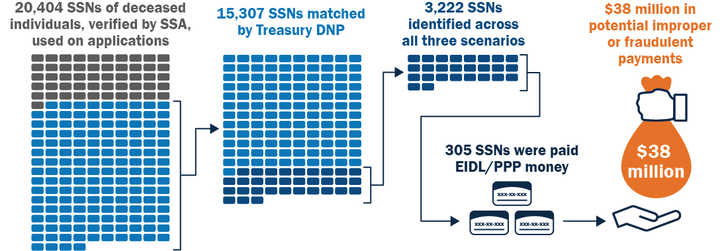

The PRAC used its CARES Act authority to have the Social Security Administration verify that 20,404 SSNs identified in our previous Fraud Alert belonged to deceased individuals. Treasury’s DNP system then provided the dates of death for 15,307 of these 20,404 SSNs, of which 3,222 deceased individuals’ SSNs were used on COVID-19 EIDL/PPP applications.

Using the PRAC’s Pandemic Analytics Center of Excellence (PACE), our data scientists analyzed these 3,222 loan applications and found they were submitted:

- after the SSN owner’s date of death, indicating potential identity fraud;

- both before and after the SSN owner’s date of death, another indication of potential identity fraud or misuse,

- or before the SSN owner’s date of death, but the loans were paid after the date of death.

PRAC data scientists determined that funds were disbursed in connection with applications using 305 of the 3,222 SSNs, totaling nearly $38 million in potentially improper or fraudulent COVID-19 EIDL/PPP payments.

“The work of the PACE makes clear why sustained data analytics capability, beyond the PRAC’s sunset and the COVID-19 pandemic, would be a gamechanger for the oversight community. Retaining an antifraud analytics center will ensure the federal government has the resources it needs to conduct effective oversight of all federal expenditures,” said Chair Horowitz.

Read the full Fraud Alert follow-up.

###

The PRAC was established by the CARES Act to promote transparency and support independent oversight of the funds provided by the CARES Act and other related emergency spending bills. In addition to its coordination and oversight responsibilities, the PRAC is tasked with supporting efforts to “prevent and detect fraud, waste, abuse, and mismanagement [and] mitigate major risks that cut across program and agency boundaries.”

If you have additional questions, please contact Lisa Reijula at lisa.reijula@cigie.gov.