Today, the Pandemic Response Accountability Committee (PRAC) issued a Fraud Prevention Alert that demonstrates how cross-agency partnerships and innovative data analytics—tools Congress provided to the PRAC—can improve program integrity by verifying identities and flagging potential anomalies in applications before taxpayer funds are sent to fraudsters.

“Our oversight work during the past five years has detailed federal agencies’ inability to use data to effectively prevent pandemic-related fraud. By contrast, the PRAC’s sophisticated data analytics capabilities allow us to look across federal agencies and programs to identify potential fraud before it occurs by comparing agency and other data with applicant-provided information, such as IP addresses, dates of birth, bank accounts, and home addresses,” said PRAC Chair Michael E. Horowitz. “As today’s report demonstrates, this data analytics capability can strengthen program integrity and prevent billions of dollars in fraud, ensuring taxpayer funds are paid to legitimate applicants.”

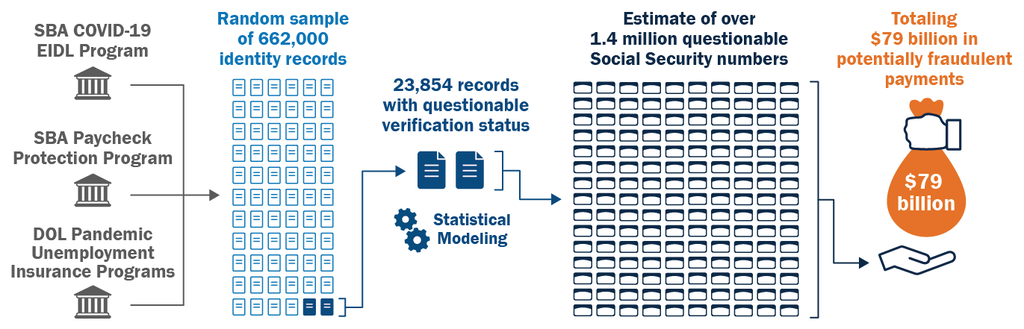

Our statistical modeling estimates that the lack of effective pre-award vetting by the Small Business Administration’s (SBA) COVID-19 Economic Injury Disaster Loan (EIDL) program, the SBA’s Paycheck Protection Program (PPP), and the Department of Labor’s pandemic unemployment insurance programs resulted in approximately $79 billion of potential identity fraud involving the use of 1.4 million potentially stolen or invalid SSNs.

Using the PRAC’s Pandemic Analytics Center of Excellence (PACE), our data scientists randomly sampled 662,000 identity records from a population of 67.5 million funded applications across major pandemic relief programs. We then provided the Social Security Administration (SSA) with the SSN, name, and (where available) date of birth from the randomly selected 662,000 records, and asked SSA to verify the following:

Is the SSN valid?

If valid, does the name associated with the SSN on the application match SSA records?

If valid, does the date of birth associated with the SSN on the application match SSA records?

Is the SSN on the application associated with a deceased individual?

SSA’s verification process flagged nearly 24,000 of the 662,000 sampled records as potentially fraudulent—either the SSN was never issued or didn’t match the applicant’s name or date of birth, indicating that they were either stolen or being used without authorization In addition, SSA informed the PRAC that over 11,000 sampled records were associated with individuals who were deceased as of the date SSA responded to the PRAC’s request. We did not include those associated loans in this fraud alert because some of the individuals may have been alive at the time of application. .

In January 2023, we issued a Fraud Alert that identified 69,000 questionable SSNs used to obtain $5.4 billion in potentially fraudulent loans and grants from SBA’s pandemic relief programs, COVID-19 EIDL and PPP. Today’s Fraud Prevention Alert builds on that previous work by using a random sampling methodology and expanding our analysis to applications from the $888 billion pandemic unemployment insurance programs to assess how identity verification upfront could have prevented additional billions in fraud.

Read the full Fraud Prevention Alert.

###

The PRAC was established by the CARES Act to promote transparency and support independent oversight of the funds provided by the CARES Act and other related emergency spending bills. In addition to its coordination and oversight responsibilities, the PRAC is tasked with supporting efforts to “prevent and detect fraud, waste, abuse, and mismanagement [and] mitigate major risks that cut across program and agency boundaries.”

If you have additional questions, please contact Lisa Reijula at lisa.reijula@cigie.gov.