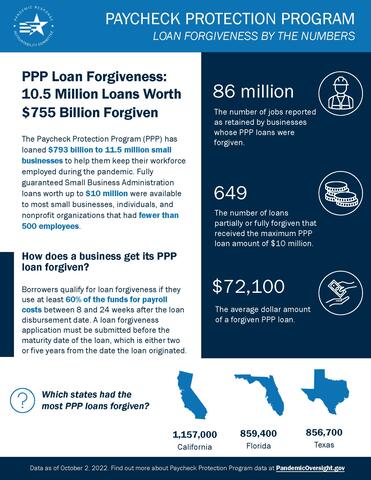

How do borrowers qualify for loan forgiveness?

If borrowers use at least 60% of the loan to cover payroll within 8 or 24 weeks after receiving the loan, they can submit an application to have the loan forgiven. Our data shows that approximately 97% of PPP loans were used for payrolls.

If you search for individual borrowers on the Paycheck Protection Program (PPP) Interactive Dashboard you may notice that for some, the amount that's been forgiven is greater than the original loan. The reason for this is that the interest on the loan has also been forgiven, which means the total dollar amount forgiven is actually higher than the original loan. You'll find a breakdown of loans forgiven in the table below, including the average amount forgiven.