Our Paycheck Protection Program (PPP) dashboard shows that 10.5 million loans out of 11.5 million have been fully or partially forgiven. The average PPP loan was $42,000, so getting it forgiven (meaning you don’t have to pay it back) could be a big financial benefit.

So, why haven’t some loans been forgiven? There are a few reasons.

Perhaps a business owner didn’t spend at least 60 percent of their PPP loan on payroll – one of the requirements for forgiveness.

It’s also possible that some businesses repaid their loans. Our data shows that 71,400 borrowers may have fully repaid their loans since there is no indication that their loan was either fully or partially forgiven.

Some borrowers may not have applied for forgiveness yet. Borrowers can apply any time before the maturity date of the loan, which is either two or five years from when the loan originated.

But there’s another potential explanation: the loan was fraudulent.

"Outstanding loan forgiveness applications are a potential indicator of fraud. Borrowers who fraudulently obtained a PPP loan are unlikely to apply for loan forgiveness,” said Mike Ware, the Inspector General for the Small Business Administration (SBA), during testimony before Congress.

By not applying for forgiveness, borrowers avoid additional scrutiny from their lender or the SBA that occurs during the application review.

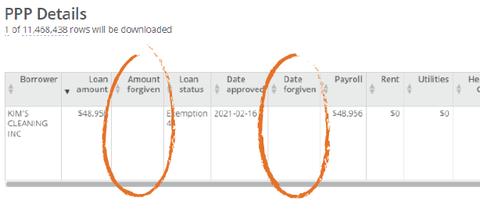

In our dashboard, you can find examples of borrowers whose loans were not forgiven and have been convicted of fraud. Like in the case of Kim's Cleaning, Inc., where an Oregon woman created a fake cleaning company to steal a $49,000 PPP loan — that she then used to gamble. You can see that there are no indications that her loan was forgiven.

With more than 11.5 million loans on our website, there’s a lot you can find in the PPP data. Use our dashboard to explore it yourself.

Search for a PPP loan recipient

Use this simple search to see how much, or if any, of their loan(s) has been forgiven.