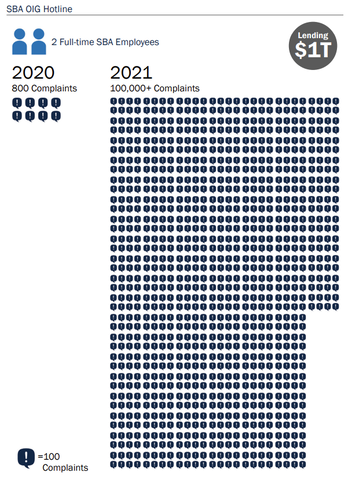

In response to the pandemic, Congress authorized the Small Business Administration (SBA) to lend more than $1 trillion to small businesses through the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) programs. But where small businesses saw a lifeline, fraudsters saw an opportunity.

In the first year after these two programs began, the agency’s Office of Inspector General (OIG) hotline saw a 19,500% increase in volume over prior years. This exceeded SBA OIG’s capacity and placed them at risk of missing actionable fraud complaints.

Our Solution:

Our data scientists partnered with SBA OIG to develop an efficient system that applied risk scores, flagging complaints with the highest probability of fraud. This Hotline Complaint Risk Model pulled information from the hotline descriptions using natural language processing techniques and applied entity resolution techniques This technique identifies data records in a single data source or across multiple data sources and links them together. to link related complaints.

Impact:

SBA OIG incorporated the Hotline Complaint Risk Model into its normal business operations and the watchdog continues to use it to prioritize complaints and investigations. According to SBA Inspector General Hannibal “Mike” Ware, of the more than 238,000 calls received they now have 40,000 actionable complaints.

Why this Matters:

The surge in hotline complaints overwhelmed SBA OIG. Without a system that helped them prioritize leads associated with the complaints, they were at risk of missing complaints that warranted action.

Learn more about the Small Business Administration’s pandemic relief programs and response to allegations of fraud, waste, and abuse.